Recently, a client told us that they were shocked that they would be entitled to half of their spouse’s pension, as the spouse had always told them that they would not see any of it. This belief is extremely common for parties to have, although it is not at all true.

Research published this month has highlighted that when it comes to the division of financial assets for separating couples, pension wealth is very unequally distributed and should be carefully considered.

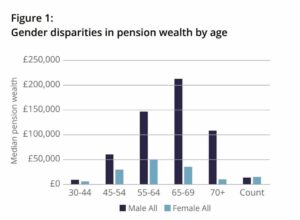

Tables from the report are pasted below; the full report can be found here.

Summary

- Men have significantly more private pension wealth than women, across all ages. As an example, the average man aged 65-69 has a median pension wealth of almost £213,000, whereas women of the same age have a median pension wealth of £35,000.

- Divorced men in the age group 55-64 who are not cohabiting have a median private pension wealth of £100,000, whereas divorced women of the same age have a pension wealth of just £19,000.

- Men aged 45-54 in their second marriages have a median private pension wealth of £68,000, whereas women of the same age who are also on their second marriage have a pension wealth of just over £30,000. At aged 55-64, the median is £162,000 for men and just £50,000 for women.

- The report also shows that over 50% of couples have a combined pension wealth of more than £140,000, and that in around 50% of couples with pensions, one partner has 90% of the pension wealth.

So what does this mean?

From a family law perspective, these figures are important to consider when looking at a division of assets upon the breakdown of a relationship.

In long marriages the starting point for the division of assets is usually 50/50. In shorter marriages then the ‘needs’ of the parties are paramount.

The report concludes that “there remains considerable potential for pension sharing when it comes to divorce, which could have a substantial impact on women’s finances in later life. Moreover, any trade-offs between house and pension in divorce may not always be balanced as pension wealth can exceed property wealth for more pension-wealthy couples, especially outside London.”

What this means in practice is that when looking to agree a financial settlement or consent order, parties should carefully consider what their incomes and assets would be in later life, as one party may be at risk of poverty or struggle financially as time passes. The report also refers to a new study currently being undertaken which will seek to survey over 3,000 recent divorces and explore the detailed financial arrangements couples make and how they work out. We will update on that once available.

What you can do

If you are in the process of separating and there are financial issues to be resolved, it is vital that you seek legal advice as soon as possible. Dealing with finances on divorce must involve full and frank disclosure by both sides, and can either be ironed out in an amicable way, or can involve contentious court proceedings. It is always our preference to assist clients in settling the matter outside of the court arena, however it is essential that you know what it is that you are entitled to, should the matter go to court, to ensure that you are both able to live comfortably off any agreed settlement.

How AFG LAW can help

There are a range of services that we can offer for a person in the process of separating, with a range of fee options to suit your needs. Our services would start at £160 + VAT or £185 + vat for a one hour consultation with a specialist, and we can support you all the way up to a final hearing to deal with finances if necessary. We can be as involved as you need us to be, as we know that financial proceedings can be costly and we will always try to save you money where possible.

Contact our team today:

Via telephone: 01204 920 101

Via email: familydepartment@afglaw.co.uk